how does kansas assess sales tax on antique cars Under the bill any car more than 35 years old would be eligible for antique registration regardless of any updates made to the car or the age of parts on the car. Legal terms used in this publication.

How Does Kansas Assess Sales Tax On Antique Cars, However for new model year vehicles the assessed value is based on a percentage of MSRP and pricing guide values are used for subsequent years. Subtract what you sold the car for. You asked 1 how the statutes define an antique vehicle for purposes of the property tax assessment limit on such vehicles and 2 for a legislative history of the assessment limit law.

Events Greeley County Kansas From greeleycounty.org

Events Greeley County Kansas From greeleycounty.org

Buying a used car especially from a private seller can be a. How does kansas assess sales tax on antique cars. Every 2021 combined rates mentioned above are the results of Kansas state rate 65 the county rate 0 to 225 the Kansas cities rate 0 to 3 and in some case special rate 0 to 1375. Montana Alaska Delaware Oregon and New Hampshire. Subtract what you sold the car for.

Payment for taxes and fees.

However for new model year vehicles the assessed value is based on a percentage of MSRP and pricing guide values are used for subsequent years. Montana Alaska Delaware Oregon and New Hampshire. 26500 385 75 950 27910. Subtract all taxes associated with the purchase. Cost- 4500 registration fee in addition to personal property tax and sales tax.

Another Article :

Decals for Antique Vehicle Model Year Tags. Antique registration means that you pay 25 once for an inspection and never have to pay for it. Cost- 4500 registration fee in addition to personal property tax and sales tax. Antique license plates do not need to be renewed property taxes will still be due annually. Fee for antique plate. If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. Vehicles Johnson County Kansas.

Call it what you like thats still a tax. This is where it gets ugly for my staff. You asked 1 how the statutes define an antique vehicle for purposes of the property tax assessment limit on such vehicles and 2 for a legislative history of the assessment limit law. In addition there is a county registration fee of 500 for a. Legal terms used in this publication. Subtract what you sold the car for. The Great Flood Of 1993 Our Red X In Riverside Missouri Riverside Through The Looking Glass Flood.

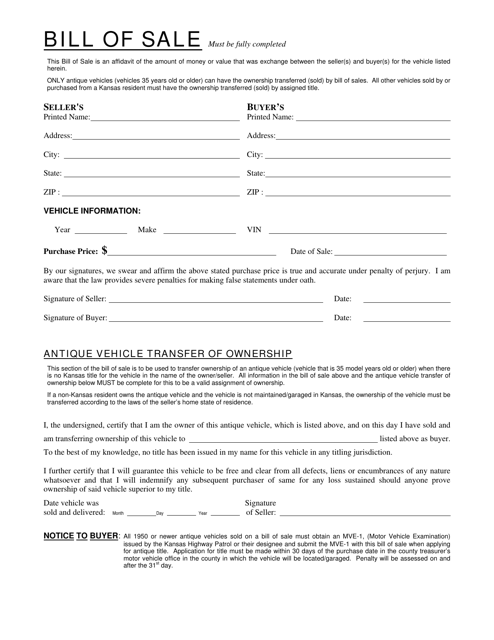

This does not include regular maintenance costs only improvements. Bill of Sale is a affidavit which must include vehicle identification number year make signature of seller and name and address of the buyer The county will collect the sales tax. Sales tax if not already paid. The tax on their sales tax returns. Short term auto rentals are taxed at 9. Do Kansas vehicle taxes apply to trade-ins and rebates. Cash For Cars Kansas City Get 480 11 000 Cash For Car.

Every 2021 combined rates mentioned above are the results of Kansas state rate 65 the county rate 0 to 225 the Kansas cities rate 0 to 3 and in some case special rate 0 to 1375. Legal terms used in this publication. Notice 09-05 Manufacturers rebate on the purchase or lease of new motor vehicles. Once the vehicle is registered you will be mailed a personal property tax statement every year in December. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool.

Look up your county assessors office. Physical proof of insurance on the vehicle showing issue and expiration date will be required. Once the documents are submitted and the fees are paid you will be issued new license plates for your vehicle. Delaware gets good marks for sales tax but it does charge a Documentation Fee which is 45 percent of the vehicle sale price or the NADA value whichever is higher. Subtract what you sold the car for. You can find these fees further down on the page. Cash For Cars Kansas City Get 480 11 000 Cash For Car.

Ordinarily your tax liability would be 3000 on a purchase like that. An Anytown KS car dealer sells a new auto with a sticker price of 28995 to a Kansas resident for 26500 plus freight of 385. You can find these fees further down on the page. Antique license plates do not need to be renewed property taxes will still be due annually. Standard antique registrationlicense plate fee is a one-time 40 fee. Look up your county assessors office. Car Frame Repair In Olathe Ks Computerized Frame Measuring.

Using an 18000 purchase price this car will cost you 1350 in sales tax. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Once the documents are submitted and the fees are paid you will be issued new license plates for your vehicle. Fee for antique plate. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Add any vehicle improvement costs to the adjusted purchase price. Cash For Cars Kansas City Get 480 11 000 Cash For Car.

An Anytown KS car dealer sells a new auto with a sticker price of 28995 to a Kansas resident for 26500 plus freight of 385. You asked 1 how the statutes define an antique vehicle for purposes of the property tax assessment limit on such vehicles and 2 for a legislative history of the assessment limit law. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Montana Alaska Delaware Oregon and New Hampshire. Notice 09-05 Manufacturers rebate on the purchase or lease of new motor vehicles. Under the bill any car more than 35 years old would be eligible for antique registration regardless of any updates made to the car or the age of parts on the car. Cash For Cars Kansas City Get 480 11 000 Cash For Car.

Legal terms used in this publication. Subtract what you sold the car for. And Notice 09-10 Cash for Clunkers aka Car Allowance Rebate System CARS. When buying an automobile if one trades in a car the state deducts the price of the trade when calculating the sales tax to be paid on the automobile eg purchasing a 40000 car and trading a 10000 car a person would be taxed on the difference of 30000 only not the full amount of the new vehicle. Do Kansas vehicle taxes apply to trade-ins and rebates. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Postcards From The Edge Of Time Page 21 Kansas City Missouri City Pictures Kansas City.

In most cases the tax is fixed at 1200. How does kansas assess sales tax on antique cars. Vehicle Sales-Page 2 Publication KS-1520 Kansas Exemption Certificate. Under the bill any car more than 35 years old would be eligible for antique registration regardless of any updates made to the car or the age of parts on the car. To get the difference you will need to contact the County Treasurer and give them the year make and model of the new as well as the old vehicle and tell them you need to know the difference in the taxes. Cities andor municipalities of Kansas are allowed to collect their own rate that can get up to 3 in city sales tax. How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price.

And Notice 09-10 Cash for Clunkers aka Car Allowance Rebate System CARS. When buying an automobile if one trades in a car the state deducts the price of the trade when calculating the sales tax to be paid on the automobile eg purchasing a 40000 car and trading a 10000 car a person would be taxed on the difference of 30000 only not the full amount of the new vehicle. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. Depending on your state this may include sales tax use tax andor wheel tax. Under the bill any car more than 35 years old would be eligible for antique registration regardless of any updates made to the car or the age of parts on the car. Cities andor municipalities of Kansas are allowed to collect their own rate that can get up to 3 in city sales tax. Missouri Car Sales Tax Calculator.

Bill of Sale is a affidavit which must include vehicle identification number year make signature of seller and name and address of the buyer The county will collect the sales tax. If a personalized antique plate is requested there will be an 4550 charge in addition to the 40 registration fee. In most cases the tax is fixed at 1200. 4000 registration fee is a one-time fee. To be subject to the 500 property tax assessment limit the law requires a vehicle to 1 be at least 20 years old 2 be of historical interest and. Legal terms used in this publication. Pdf The Big Three Of The Auto Industry Analyzing And Predicting Performance.

Buying a used car especially from a private seller can be a. Standard antique registrationlicense plate fee is a one-time 40 fee. To be subject to the 500 property tax assessment limit the law requires a vehicle to 1 be at least 20 years old 2 be of historical interest and. Delaware gets good marks for sales tax but it does charge a Documentation Fee which is 45 percent of the vehicle sale price or the NADA value whichever is higher. For most vehicles Fairfax County has chosen to use the clean trade-in value as listed in the pricing guide. Once the vehicle is registered you will be mailed a personal property tax statement every year in December. Wyandotte County Kansas Vehicle Bill Of Sale Download Fillable Pdf Templateroller.

Sales tax if not already paid. Subtract all taxes associated with the purchase. Once the documents are submitted and the fees are paid you will be issued new license plates for your vehicle. To be subject to the 500 property tax assessment limit the law requires a vehicle to 1 be at least 20 years old 2 be of historical interest and. This document mainly just validates the purchase price of the deal although if the sale involves an antique vehiclethat is one thats 35 years old or olderthis form can officially transfer ownership without a title. Decals for Antique Vehicle Model Year Tags. Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media.

Ordinarily your tax liability would be 3000 on a purchase like that. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Related Kansas Statutes KSA 8-172. The tax on their sales tax returns. Subtract all taxes associated with the purchase. Payment for taxes and fees. Events Greeley County Kansas.